The BVI Segregated Portfolio Company (SPC) allows a company to segregate the assets and liabilities of different portfolios (also known as ‘cells’ or ‘sub funds’) within a single company structure. The assets and liabilities of each segregated portfolio (SP) within the SPC are attributable to the segregated portfolio to which the assets and liabilities belong to and are protected by statute from the general liabilities of the SPC and the liabilities of all the other segregated portfolios within the same SPC.

Understanding the Governance Structure of SPCs

The SPC has a single board of directors which controls the day to day activities of the SPC and are responsible for keeping the assets of each segregated portfolio separate from the general assets of the company and from the assets of other segregated portfolios.

A company may be incorporated as a segregated portfolio company with the written approval of the BVI Financial Services Commission (FSC). The name of a segregated portfolio company must include the designation “Segregated Portfolio Company” or “SPC” in its name.

Fund Registration

SPCs can be licensed as BVI funds under the Business Companies Act (BCA). Open-Ended funds are those where investors have the right to redeem on demand a proportionate interest in the value of the Fund at a specified valuation period, and are required to be licensed by the FSC, the BVI regulatory authority. In Closed-Ended funds registered as Private Investment Funds, investors do not have an automatic right of redemption.

The Open-Ended funds include Public Funds, Professional Funds, Private Funds, Approved Funds, or Incubator Funds, each with their separate regulatory requirements. Once an SPC is licensed as a fund, it will be subject to the regulatory requirements of that particular fund license.

Private Funds

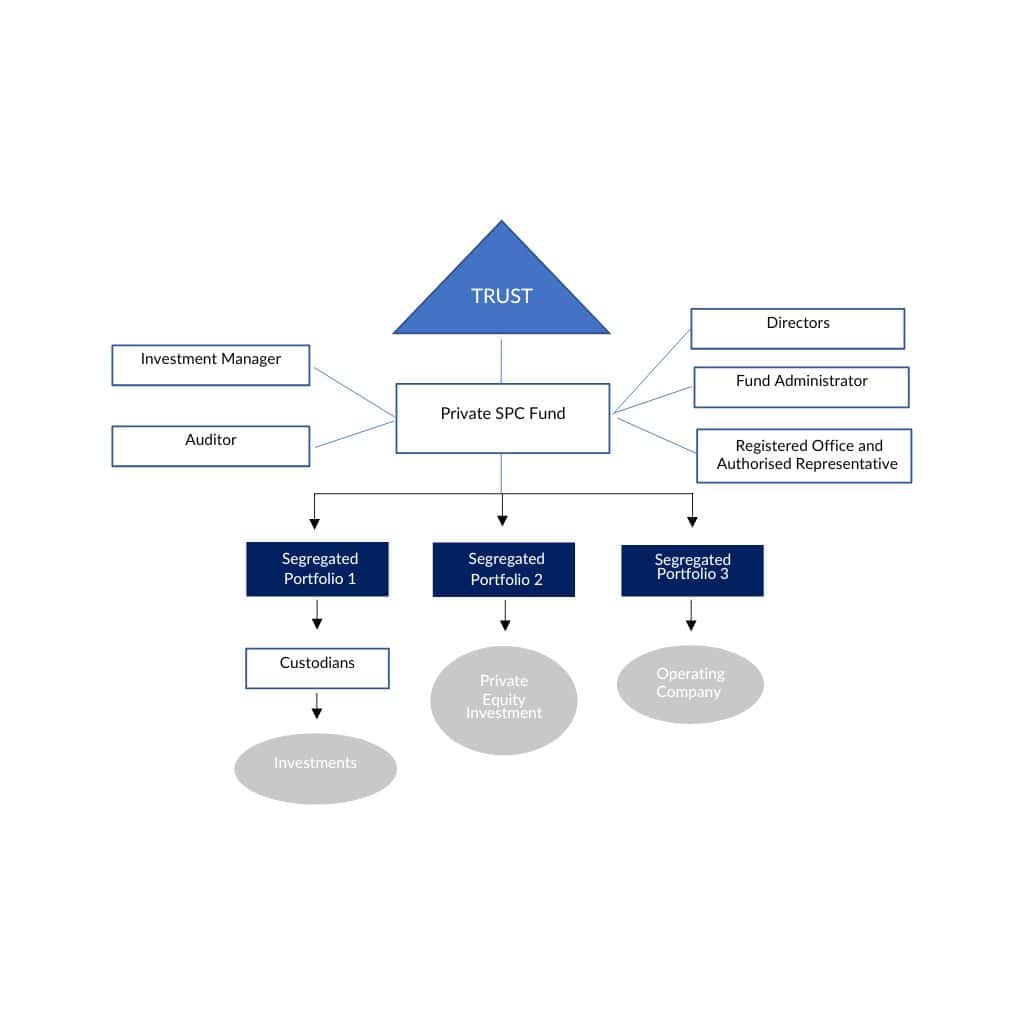

SPCs licensed as Private Funds are ideal for the assets of an individual or a family group, and would be created for the exclusive use of an individual or family with no external investors. BVI Private Funds require Directors, a Fund Administrator, a Resident Agent, an Authorized Representative, an Investment Manager, a Custodian, and an Auditor.

Multiple Portfolios

An SPC allows for the creation of multiple portfolios within a single company structure. Each segregated portfolio (SP) has its own investment strategy, financial records, and set of investors. This flexibility is invaluable for fund managers and investors who wish to operate diverse strategies under a single structure without the need to establish multiple legal entities, saving time, minimizing cost and administrative burden.

Segregation of Liability

Cost Efficiency

Operating separate portfolios within a single SPC is more cost-effective than setting up and maintaining multiple companies. This is particularly advantageous for smaller or start-up funds, as it minimizes initial costs while maintaining scalability.

Administrative Efficiency

Managing multiple portfolios under one umbrella fund simplifies administrative processes and enhances operational efficiency.

Advantages over Corporate Vehicles

SPCs are licensed entities, and are exempt from the BVI Economic Substance rules and the BVI Beneficial Owner Registration rules.

BVI Probate

As with shares of ordinary BVI companies, shares of SPCs are subject to probate on the death of the shareholder, and should be held by a Trust.

Contact CISA Funds

SPC Structure